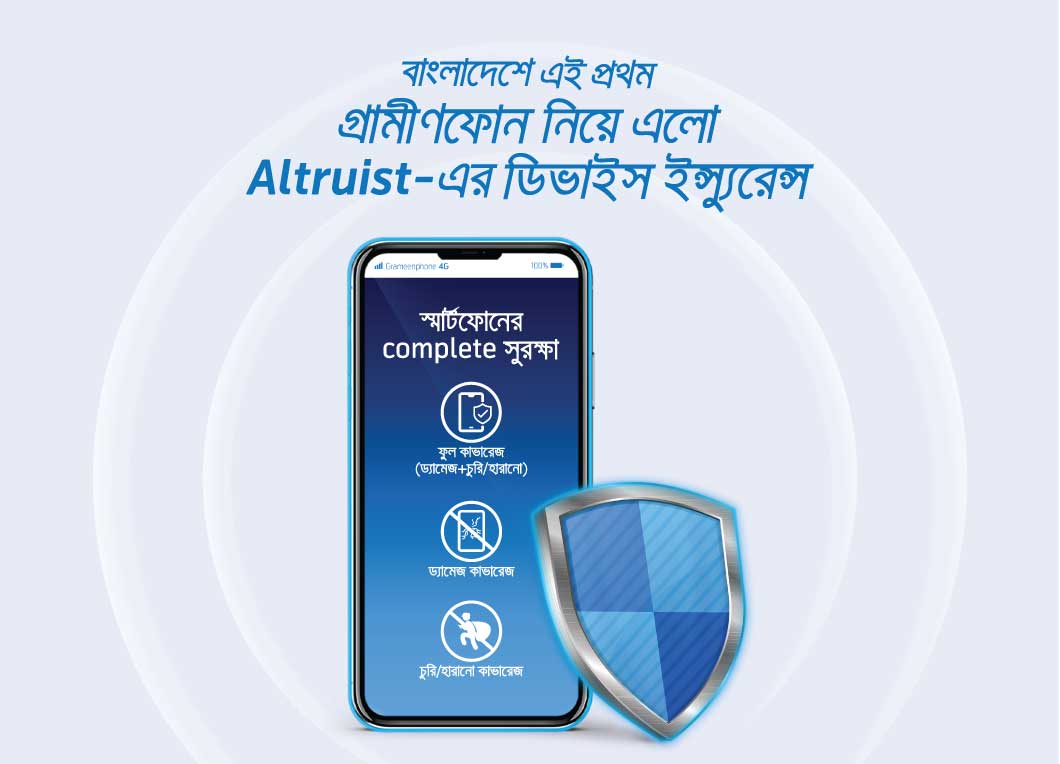

Device Insurance- Your Device’s Full Protection

Secure your device with insurance from Altruist Technologies Limited. Our comprehensive Device Insurance offers protection against accidental damage, ensuring that your device remains safeguarded. Whether it's a drop, spill or any unforeseen incident, our coverage provides the financial support you need, allowing you to use your device with confidence and peace of mind.

About Altruist Secure Device Insurance:

Altruist Secure is an app-based Device Insurance subscription that provides coverage for physical damage, theft and loss (any kind of line on the screen is not covered). This annual subscription offers 12 months of comprehensive protection from the activation date. Customers can choose to pay the premium in full upfront or opt for convenient monthly installments, ensuring peace of mind with year-round coverage for their devices.

Eligibility for Device Insurance:

Recently purchased smartphone (iOS/Android) from a physical or online retailer.

Existing smartphones up to 13 months old, based on the purchase date stated on the invoice.

A valid purchase invoice is required, clearly mentioning the device brand, model, MRP, and IMEI number.

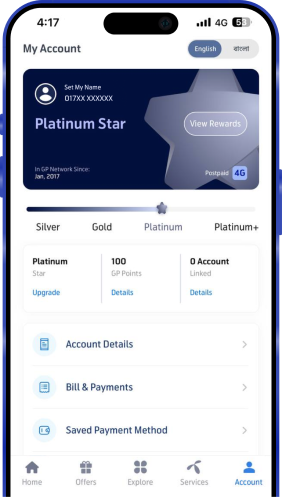

Subscription is available only for Grameenphone numbers.

Altruist Insurance Policies:

Damage Coverage

Theft / Lost Coverage

POLICY DESCRIPTIONS:

Coverage detail:

Damage coverage:

Coverage for accidental physical damage, including screen damage, resulting from incidents like fire, liquid ingress, or mechanical shock (any kind of line on the screen is not covered).

1. Option1: 1: Altruist's logistics partner will pick up and return the repaired phone at your doorstep within 7 business days. This service does not require additional cost.

2. Altruist's logistics partner will collect your damaged device within 2 business days in metropolitan areas and 7 business days in districts, following the completion of the required documentation. Repairs for devices out of the manufacturer's warranty will take up to 7 business days and will be done using grade 1 replacement parts by our repair partner, Quickfix.

3. If your device is still under the manufacturer's warranty, it will be sent to the authorized service center for repair using original parts. The estimated repair time will be provided by the service center and may vary. Please note that failure to pay the Customer Contribution to Claim (CCTC) within 48 hours may impact the overall repair timeline.

4. Option 2: If the first option is not feasible, Altruist may opt for the second option. If the standard repair process is not feasible, Altruist may offer an alternative solution. Customers may choose to repair their devices locally and receive reimbursement from Altruist, up to the depreciated device value. Reimbursement will be processed within 7 business days of submitting the necessary documents and bills.

5. Option 3: If the first two options are not feasible, Altruist may choose the third option. If neither of the first two options is feasible, Altruist may offer a final solution by paying the full depreciated device value to the customer. In return, the customer will need to permanently surrender the device to Altruist. The payment will be processed within 7 business days of receiving the device.

Theft/ Lost coverage:

To claim for a lost or stolen device, you must provide a valid General Diary (GD) report for loss or a First Information Report (FIR) for theft, along with a copy of the lost SIM replacement certificate from a Grameenphone service point.

- Coverage detail: The insurer will reimburse the depreciated Insured value within 10 business days of receiving all necessary documents.

Conditions for Device Insurance Subscription:

Customers can opt for Damage Coverage, Theft/Loss Coverage, or Full Coverage, which combines both.

Coverage period: All policies offer 12 months of insurance protection.

Payment method: Premiums are payable via bKash.

Payment frequency: Premiums can be paid quarterly, half yearly or annually.

Claims eligibility: The full annual premium must be paid before making any claims.

Damage claims: Customers may make multiple damage claims within the coverage period.

Theft/Loss claim: A theft or loss claim is limited to one per coverage period.

Payment grace period: Failure to pay the premium within 7 days of the due date will void the insurance.

Customer contribution: For each claim, customers pay either BDT 1,000 or 10% of the claim value, whichever is lower.

Reporting requirements: Claims must be reported within 7 days of the incident (damage, loss, or theft), with required documents submitted within 15 days. The insurer will process payments within 10 working days of claim submission.

Please visit http://bd.altruistsecure.com/ for details

Dear customer, if you're interested in a Device Insurance subscription, please click here to download Altruist Secure BD the Altruist Secure BD mobile app.

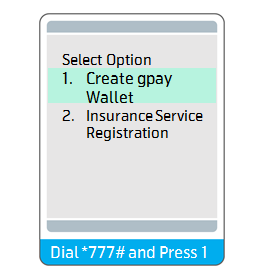

Subscription process and medium:

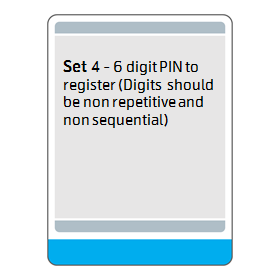

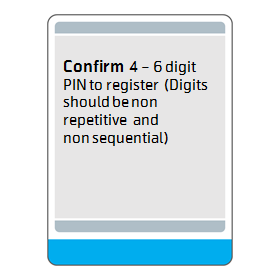

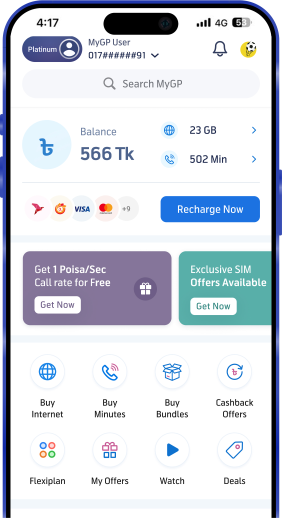

After unboxing your newly purchased device from GP retail stores or the GP online shop, start by downloading the Altruist Secure BD app from the Play Store or App Store. Once the app is installed, enter your mobile number for OTP verification. An OTP will be sent to authenticate your login.

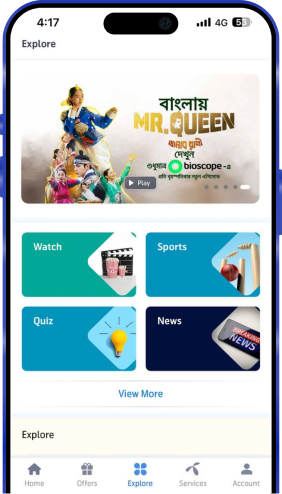

Below is the app interface you’ll find on the App Store and Play Store, along with the OTP verification screen that appears upon opening the app.

User Registration Form: User has to provide the correct details such as-

Full Name

Email ID

Mobile number (auto-fetched after OTP verification)

IMEI

Invoice Amount

Invoice Date

National ID/Birth Certificate

Father’s Name

After filling up the information, the user will see an Upload Invoice button below their details. To upload the original invoice or cash memo, the user should click this button, which activates the phone’s camera to capture an image of the invoice. The user must ensure that the picture displays the device brand, model, IMEI, and MRP information.

Below is a preview of the user registration form and the invoice upload option on the screen:

Once the user details and purchase invoice are submitted, the app will request permission to run a device health check. After granting permission, the user must stay attentive and respond to any prompts required during the test, as shown below:

The user can monitor the success of each test in real time, as results are displayed immediately. To be eligible for the device insurance subscription, the test rating must be at least 85%. If needed, the user can repeat the test by selecting the Test Again option. Note that any tests that fail will not be covered under the protection plan, as shown in the health report.

After a successful test result, the user will need to use a second phone to capture the IMEI of the device being Insured. The app will display a QR code on the first phone (testing phone) for the user to scan with the second phone. Upon scanning the QR code, a camera icon will appear on the second phone’s screen, allowing the user to capture the IMEI displayed on the first phone.

On the first phone, the app will prompt the user to dial *#06# to display the IMEI. The user will then click the camera icon on the second phone, which will activate the camera to capture the IMEI from the first phone. The image will be uploaded for verification.

IMEI matching will be conducted using both the invoice and the IMEI number displayed on the screen after dialing *#06#. During this process, users can also track the status of their invoice approval directly on the screen below:

The app will display various insurance plans with monthly and annual premium options. Users can select a plan based on their needs and make the payment via bKash by clicking on "Pay."

The bKash interface will appear, displaying the premium amount to be charged from the customer's bKash wallet. The customer will need to enter their bKash account number, OTP, and PIN to complete the payment. Please ensure that your bKash account has sufficient balance for the transaction.

Once the payment is successfully done, the user will be eligible for a subscription to Altruist Secure and will be able to access their subscription dashboard.

The images of the uploaded invoice and IMEI will be verified by Altruist Secure BD within 48 hours. If the uploaded images are verified successfully, the user will be subscribed, and the cooling period will begin. If any issues are found with the images, the user will be contacted via the hotline (01730805151 on WhatsApp) for further information.

Payment Status: Users can track their payment history and upcoming payments.

Policy Certificates: Customers can view their policy certificates after uploading their ID proof, and they can download and print the certificate for their records.

Profile management: Users can verify their subscription and personal information details on this page.

Invoice Approval: After successfully uploading the invoice, Altruist’s backend team will review and approve or reject it, as it is essential to determine the Sum Insured value. If the purchase invoice is valid and issued by an eligible sales channel with all required information, it will be approved within minutes. Otherwise, the uploaded invoice will be rejected, and the customer will not be able to proceed with the insurance subscription.

The user registration form and invoice upload option are available on the screen shown below:

Maximum Sum Insured value will be determined based on below table:

The age of the Insured device is calculated from the purchase invoice date to the insurance subscription date | Identification of the Sum Insured value for maximum coverage and the corresponding insurance premium will be based on the following factors: |

|---|---|

0-3 months | 100% of the valid invoice value |

4-6 months | 80% of the valid invoice value |

7-9 months | 70% of the valid invoice value |

10-13 months | 60% of the valid invoice value |

The Depreciated Sum Insured Value (Maximum Insurance Coverage Value) at the time of a claim will be determined according to the table below:

The age of the Insured device is calculated from the subscription activation month. | Depreciated Value |

|---|---|

0-15 days | Cooling period |

15 days-3 months | 90% of the Sum Insured value |

4-6 months | 80% of the Sum Insured value value |

7-9 months | 70% of the Sum Insured value |

10-12 months | 60% of the Sum Insured value |

Coverage Claim process against incident:

A customer can raise a claim through the following channels:

Service Request via Online Portal

Visit Altruist’s website at http://bd.altruistsecure.com and log in using your registered mobile number.

Service Request via Email

Send an email to bangladesh.cc@altruistsecure.com

Service Request via Customer Care Number

Call the Customer Care number at 09612449966

A customer must file a claim within 7 days of the incident to be eligible for coverage. All required documents to support the claim must be submitted to the insurer within 15 days of the incident.

A customer needs to provide the following information when raising a claim:

1. Mobile Number and National ID Number

2. Date of the Incident

3. Type of Claim (Damage/Theft/Loss)

4. Damage Device Pictures (Front and Back)

5. In Case of Theft: A copy of the FIR from the local police station

6. In Case of Loss: A copy of the GD from the local police station

7. In Case of Loss/Theft: A copy of the SIM replacement receipt issued by the GP Service Point

The user will receive updates on their claim via email and SMS. Additionally, an executive from Altruist Technologies may contact the user by phone if required:

For repair claims, there is no limit on the number of claims within 1 year, if the total repair cost does not exceed the depreciated Sum Insured.

Before processing a claim, the customer must pay the CCTC (10% of the claim amount or 1000 taka, whichever is lower).

At the time of the first claim, the customer must pay the full annual subscription fee in advance, or the remaining months if on a monthly plan. For example, if the first claim occurs in the 4th month, the customer must pay the remaining 8 months’ fee in advance. After this, no further subscription fees are required for the coverage period, and only the CCTC will apply for subsequent claims.

What is the maximum claim amount based on the device's age and subscription type?

It will follow the example below:

Header | Value |

|---|---|

Device Purchase date | 1-Sep-20 |

Device Value as per Invoice | 10000 |

Subscription activation date | 1-Jan-21 |

Device age from purchase date | 4 months |

Depreciation % of the invoice value as per table | 80% |

Sum Insured Value as per depreciation % table | 8000 |

Monthly premium for Damage Coverage Policy [Including VAT+SD] | 73.6 |

1st Claim Date | 1-Mar-21 |

Age of Insured device from subscription activation | 3 months |

Depreciation % of Sum Insured Value as per subscription age | 90% |

Depreciated Sum insured | 7200 |

Maximum claim eligibility in the 3rd month: | 7200 |

Example of 1st Claim Value | 1500 |

Date of 2nd Claim | 1-June-21 |

Device Age Since Subscription Activation | 6 Months |

Depreciation Percentage of Sum Insured According to Subscription Age | 80% |

Depreciated Sum Insured | 6400 |

Maximum Claim Eligibility in the 6th Month | 4900 |

Example of 2nd Claim Value | 1500 |

Date of 3rd Claim | 1-Sept-21 |

Device Age at the Time of Claim from Subscription Activation | 9 Months |

Depreciation Percentage of Sum Insured According to Subscription Age | 70% |

Depreciated Sum Insured | 5600 |

Maximum Claim Eligibility in the 9th Month | 2600 |

Example of 3rd Claim Value | 1000 |

No claims will be accepted during the first 30 days after activation. Customers will be eligible to file a claim starting from the 31st day. The first 30 days of active service are considered the "Cooling Period." During this period, the policy cannot be returned for any reason.

Before handing over your damaged smartphone to our courier for repairs, please make sure to

1. Backup your files.

2. Remove your SIM card and any other memory cards.

3. Unlink your phone from your email, messaging apps, social media accounts, or any other connected services.

4. Disable any security locks (e.g., PIN, password, or fingerprint).

5. Place your smartphone in bubble wrap or another suitable packaging material provided by the logistics partner, and pack it securely in a sturdy box to ensure protection during transit.

6. Clearly label the box with your name and the details provided by Altruist Secure via SMS (e.g., AWB number and Altruist address)

CCTC (CCTC (Customer Contribution to Claim) is 10% of the claim or repair value, or 1000 taka, whichever is lower. The customer must deposit this amount immediately after the in-principal approval, directly into the Altruist account via bKash.

Altruist will take full responsibility for the Device Insurance service, managing the entire value chain and customer journey.