[Dhaka, 16 July, 2024] Grameenphone Ltd. reported a total revenue of BDT 42.2 billion for the second quarter of 2024, registering a growth of 5.6% from the same period last year. The Company acquired 2.3 Mn new subscribers, reaching 85.3 Mn total subscribers at the end of the second quarter. 58.3% of Grameenphone’s total subscribers, or 49.7Mn, are using internet services.

Key Figures (BDT) | Q2 2024 |

Revenues (Bn) | 42.2 |

Revenues Growth YoY | 5.6% |

Net Profit After Taxes (Bn) | 8.6 |

NPAT Margin | 20.4% |

EBITDA Margin | 60.4% |

Earnings Per Share | 6.38 |

Capex (excl. license, lease & ARO) (Bn) | 4.6 |

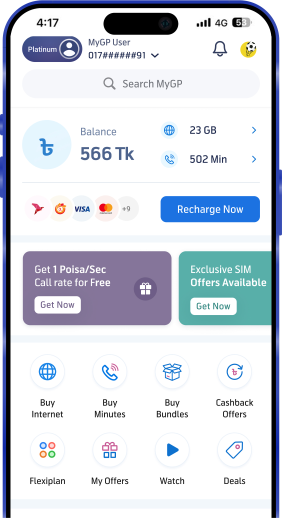

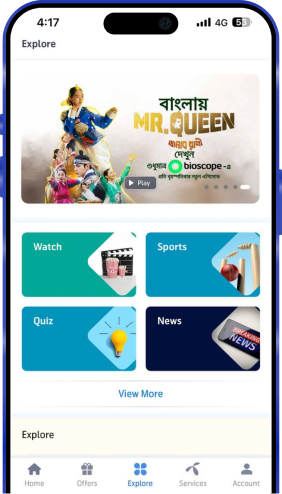

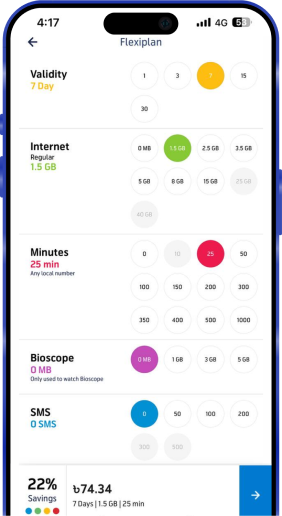

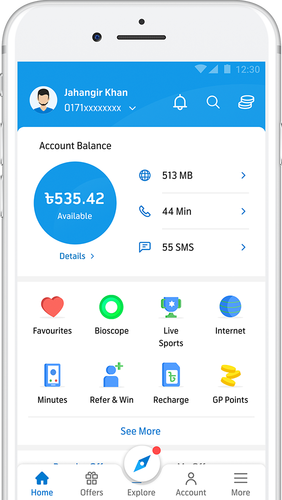

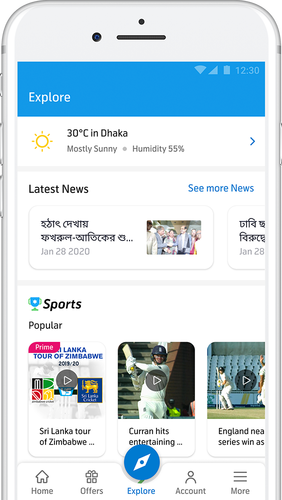

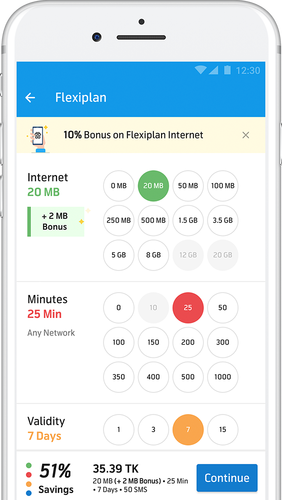

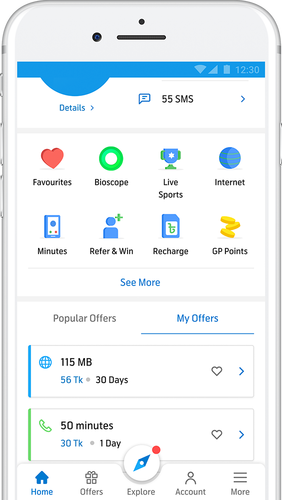

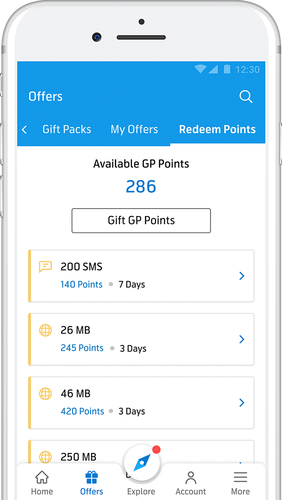

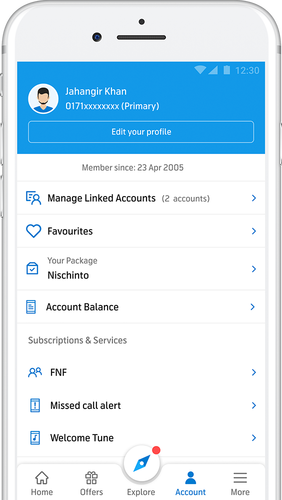

“The macroeconomic headwinds that have been prevalent since last year exacerbated due to central banks' continued tightening policies, calibration of energy prices while reducing subsidies, increase of supplementary duties and the effects of natural disasters such as cyclones and flood. Despite these challenges, we remained focused on our growth strategies and showed stability in our performance by delivering consistent growth in topline and EBITDA. Our MyGP app continues to be the largest local self-service app in Bangladesh with now a staggering 20 million monthly active users.”, said Yasir Azman, CEO of Grameenphone Ltd. “Focusing on the utilization of AI technologies, we have introduced smart & adaptive strategies such as deploying an AI-powered dynamic network optimization system that delivers seamless connectivity based on real-time movement. At Grameenphone, we are deeply committed to building a sustainable future and making a positive difference in the communities we serve. We strategically partner with businesses that share our values and actively support ESG (Environmental Social Governance) initiatives as a crucial aspect of our social and economic responsibilities bestowed upon us as leaders in this industry” he added.

“We are now through the first half of the year, and I am pleased to see that after a good Q1, we continue to see good progress across all metrics and segments in this quarter as well. In Q2, we saw good trends on ARPU and Subscriber sides and increased our growth rate to 6.4% YoY growth in Subscription & Traffic Revenue, up from 5.2% in the previous quarter. Through relentless focus on efficiency and automation, we have been able to offset cost pressure and deliver a solid EBITDA margin of 60.4%. This was the thirteenth consecutive quarter of growth in both topline & EBITDA. I am particularly pleased to report that supported by the positive momentum and strong balance sheet, the Board has recommended an interim dividend of 16 taka per share to be paid out this quarter.” said Otto Risbakk, CFO of Grameenphone Ltd.