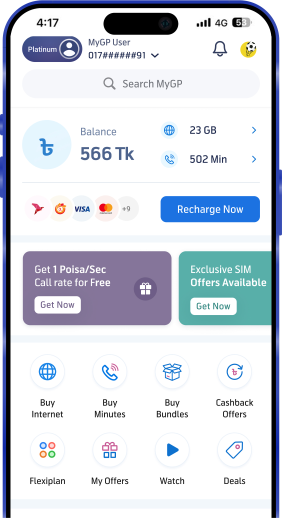

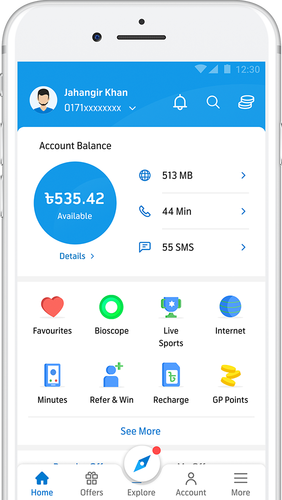

[Dhaka, 25 April, 2025] Grameenphone Ltd. reported a total revenue of BDT 38.3 billion for the first quarter of 2025, registering a decline of 2.5% from the same period last year mainly due to the challenging macro economy. The Company reported a total subscriber base of 84.8 million at the end of the first quarter. 57.0% of Grameenphone’s total subscribers, or 48.3 million, are using internet services.

Key Figures (BDT) | Q1 2025 |

Revenues (Bn) | 38.3 |

Revenues Growth YoY | -2.5% |

Net Profit After Taxes (Bn) | 6.3 |

NPAT Margin | 16.5% |

EBITDA Margin | 57.4% |

Earnings Per Share | 4.69 |

Capex (excl. license, lease & ARO) (Bn) | 4.8 |

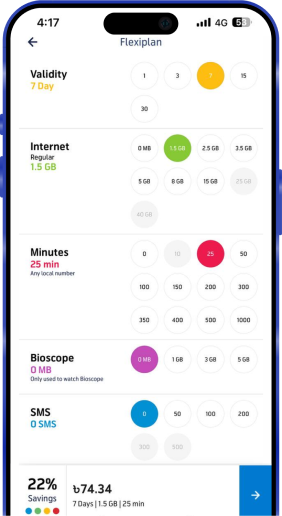

“Although we’re still navigating through the challenges of this difficult macro environment, with the strategic measures we've put in place our financial performance is improving. Data user and usage growth remained strong this quarter, but revenue fell year-over-year due to a sharp 17% drop in data pricing. We are stepping into a new era of innovation through the transformation of our IT and network infrastructure, laying the foundation data & digital centric economy in the country. Each quarter, we’re driving significant IT transformation initiatives that are boosting service reliability and delivering highly personalized experiences,” said Yasir Azman, Chief Executive Officer of Grameenphone Ltd.

“Sustainability is a part of Grameenphone’s growth and legacy. Our Digital Inclusion Project has trained more than 3.1 Mn people last year and this quarter we continue this journey by upskilling over 220 thousand individuals, mostly women from marginalized communities. Looking ahead, our focus remains clear: to sustain the momentum of innovation. We are committed to investing in cutting-edge technology, digitalize our operations, and continually enhancing the customer experience. With early signs of economic recovery, we are confident that our business is well-positioned to return to a growth trajectory in the coming days,” he added.

Otto Magne Risbakk, Chief Financial Officer, Grameenphone, said, “As anticipated last quarter, the gradual recovery of the economy is leading to a rebound in both data usage and subscriber growth. After two consecutive quarters of decline, ARPU has finally taken an uptick in Q1’25. On a YoY basis, we’ve registered a decline of 2.5% in total revenue, largely driven by cautious consumer spending. But if we normalize the leap year effect from last year, our year-over-year performance shows we're only 1% behind. Solid Operational Excellence programs and sharp capital allocation allowed us to reach an EBITDA of BDT 22 Bn for the Q1’25 and maintain an EBITDA margin of over 57%. On a reported basis, we see a 53% decline year -over-year in NPAT. However, excluding the one-off reversal of the tax provision, NPAT is down by only 24.9%, reflecting mainly the revenue decline, higher costs and depreciation from continued modernization and higher finance costs mainly due balance sheet restatements from a weaker BDT.